Daily Forex Quantitative Trading Ideas And Analysis - 12 April 2018

Some highlights from the daily ATI report going into Thursday's trading session-

$AUDCAD is showing a short-term downside momentum extreme and is likely to retrace higher.

$CHFJPY short-term momentum switched to the downside.

While CAD has been the strongest of the 8 majors, it is also showing a short-term extreme high momentum with a caution flag for longs. EUR also switched from short-term downside to upside momentum.

$EURCHF is showing a long-term upside momentum extreme and is likely to retrace lower.

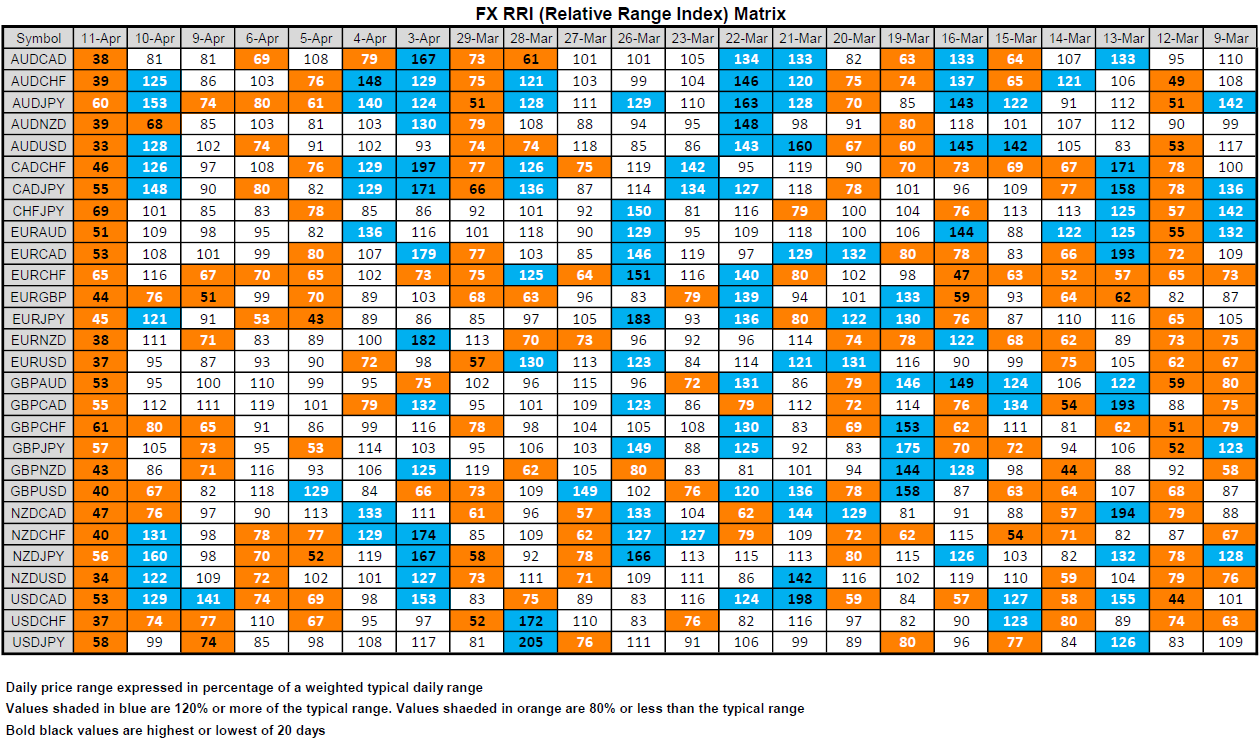

Several currency pairs are due for directional range expansion, including: $AUDCHF, $AUDUSD, $EURJPY, $EURUSD, $EURGBP, $GBPUSD, $NZDUSD and $USDJPY.

We analyze volatility and range using several metrics. Due to the unusually large number of range contractions a screenshot of RRI (Relative Range Index) is included with this post so you can see the significant number of relatively low ranges (highlighted in orange).

Additionally, $AUDCHF had a 3-day pivot reversal to the upside.

Please feel free to reach out to [email protected] with any questions or comments. We would love to hear from you!

Have a great day!

Check out the limited-time Andersen Trading Solutions (ATS) dashboard trial

Get your fully-featured Forex and Commodities dashboard reports packed with institutional quality analytics and research for actionable trading ideas. Sign up now for your 14-day trial and see how you can significantly enhance your trading results.