Daily 10 momentum stocks - 24 April 2018

Top 5 short-term momentum stocks of the S&P 100: $OXY $LMT $MON $MRK $RTN

Bottom 5 short-term momentum stocks of the S&P 100: $QCOM $PEP $CL $BMY $PM

Top 5 long-term momentum stocks of the S&P 100: $MON $RTN $COP $OXY $BKNG

Bottom 5 long-term-term momentum stocks of the S&P 100: $BMY $PG $BIIB $CMCSA $KHC

Daily 10 momentum stocks - 20 April 2018

Top 5 short-term momentum stocks of the S&P 100: $MON $OXY $COP $HAL $BKNG

Bottom 5 short-term momentum stocks of the S&P 100: $T $PEP $KHC $IBM $BMY

Top 5 long-term momentum stocks of the S&P 100: $FOXA $COP $NEE $RTN $BKNG

Bottom 5 long-term-term momentum stocks of the S&P 100: $BIIB $CMCSA $PG $GE $KHC

Daily Forex Quantitative Trading Ideas And Analysis - 20 April 2018

Highlights from the daily Forex ATI Dashboard report going into Friday, 20 April-

Short-term momentum changes:

Bullish - $EURGBP, $USDCAD

Bearish - $AUDUSD, $GBPJPY, $GBPUSD, $NZDJPY, $NZDUSD

Structural change has occurred for $GBPUSD (bearish) and $EURGBP (bullish).

Interestingly there were no pivot gaps on Thursday. The last time this occurred was on 8-Feb of this year.

Several of the key range expansions and price reversals from extremes that we have been anticipating and sharing have occurred. However, there are a few pairs/crosses which are likely to experience range expansions including: $EURCAD, $USDJPY, and $CADCHF

Attached to this post is an image showing Relative Range Indexes (RRI) for each currency pair to show how daily price ranges have recently increased as a percentage of their typical range. Values highlighted in blue represent 120% or greater of their typical range while those highlighted in orange were 80% or less. Bold black numbers were the highest or lowest...

Daily 10 momentum stocks - 19 April 2018

Top 5 momentum stocks of the S&P 100 are: $MON $BKNG $OXY $CVX $HAL

Bottom 5 momentum stocks of the S&P 100 are: $BAC $WFC $PEP $IBM $BMY

Daily Forex Quantitative Trading Ideas And Analysis - 19 April 2018

Highlights from the daily Forex ATI Dashboard report going into Thursday, 19 April-

Short-term momentum reversed up for $AUDNZD, $NZDJPY, and down for $GBPAUD.

While $GBPCHF has begun its decent as anticipated, short-term momentum for $EURCHF is ranked 1st and $USDCHF is 2nd. Conversely, $CHFJPY is ranked lowest at 28th and $USDCAD is 27th.

Price range is anticipated to increase for the following pairs/crosses:

$AUDJPY, $CHFJPY (also an inside day, doji, and NR7), $EURJPY, $NZDJPY, and $USDJPY.

Additionally, pivots for $USDCHF reversed to bullish and $NZDUSD bearish.

Included with this post is a table showing the 3-day price range in USD per lot for the 28 majors then color coded from highest (dark green) to lowest (dark red) for each currency pair/cross. Notice how the range leader each day was GBP, flowing diagonally over the last several days, ending with $GBPUSD.

Please feel free to reach out to [email protected] with any questions or comments. We would love to hear...

Daily 10 momentum stocks - 18 April 2018

Top 5 momentum stocks of the S&P 100 are: $OXY $MON $COP $SO $AMZN

Bottom 5 momentum stocks of the S&P 100 are: $C $GS $CMCSA $WFC $BMY

Daily Forex Quantitative Trading Ideas And Analysis - 18 April 2018

Highlights from the daily Forex ATI Dashboard report going into Wednesday, 18 April-

Short-term momentum reversed up for $EURNZD and down for $GBPCAD, $NZDJPY, and one major currency - the New Zealand Dollar.

$EURCHF, $GBPCHF, and $CADCHF are at extreme short-term momentum levels and ranked 1,2,3 respectively. Similarly, the Swiss Franc is also at extreme low momentum levels.

Daily price range analysis suggests range and volatility are likely to increase for $AUDJPY, $AUDUSD, $CADJPY, $USDCAD and $USDJPY.

3-day range analysis suggests range and volatility are likely to increase for $AUDUSD, $CADJPY, and $EURJPY.

Pivot analysis indicates $EURAUD, $EURNZD, $CADJPY, and $USDCAD will see increased price action.

Additionally, $EURNZD had a bullish pivot reversal and $NZDJPY had a bearish pivot reversal.

Included with this post is a table of the short-term momentum heat map ranking for each currency pair from highest (green) to lowest (red) for each currency pair/cross and the 8 major...

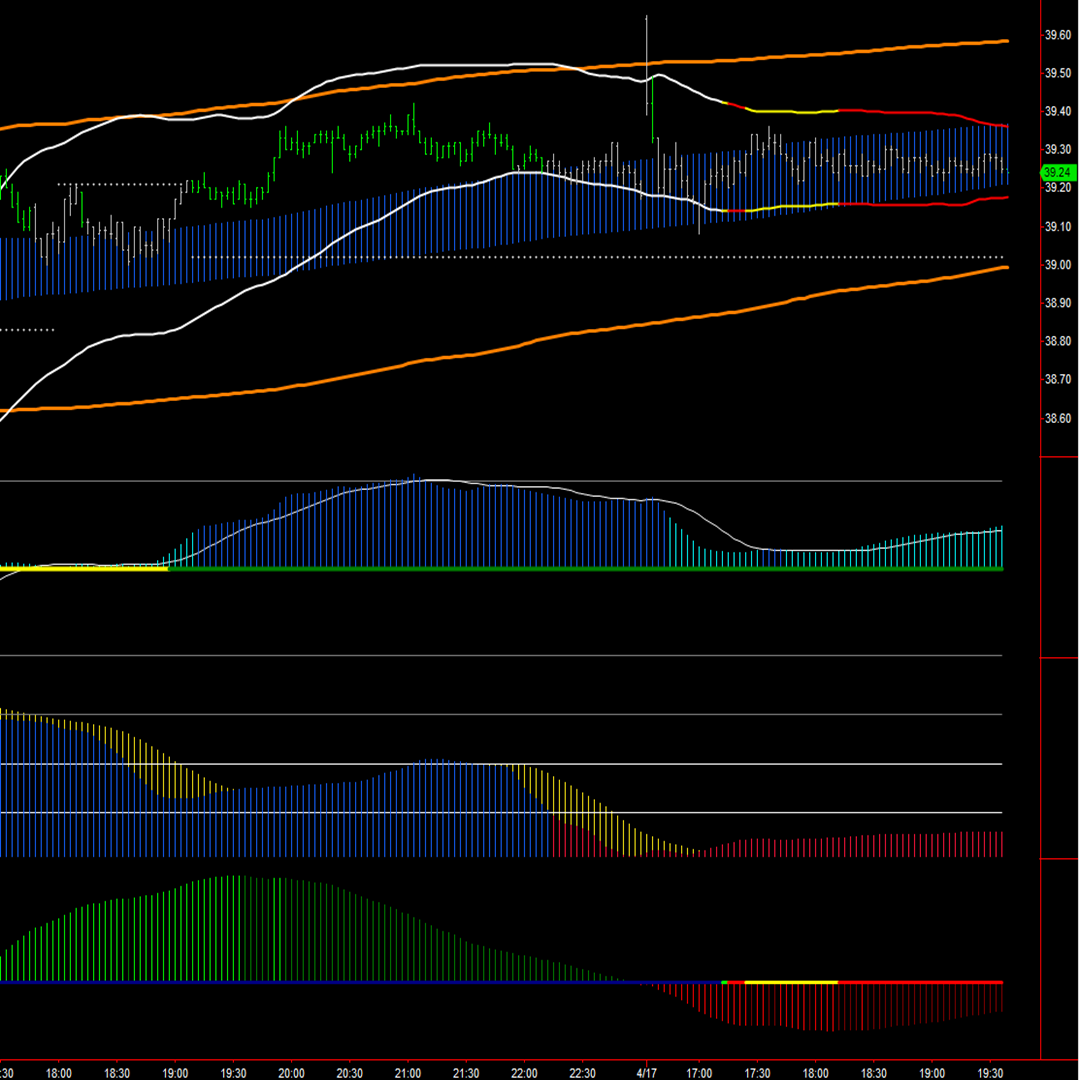

General Motors $GM about to breakout

General Motors $GM is showing an Andersen Bands Squeeze ("Type 3") for an imminent breakout on a short-term basis.

Daily Forex Quantitative Trading Ideas And Analysis - 17 April 2018

Highlights from the daily Forex ATI Dashboard report going into Tuesday, 17 April-

Short-term momentum reversed up for two pairs/crosses: $EURAUD, $GBPCAD, while majors EUR turned up and AUD turned down. Long-term momentum turned up for $EURJPY.

$GBPCHF and $EURCHF are at extreme momentum levels ranked #1 and #2 for both ST and LT momentum respectively.

Daily price ranges for $AUDUSD, $AUDJPY, $CADCHF, $CADJPY, and $NZDJPY are likely to increase, while $EURCAD is likely to see an increase in both daily and 3-day price ranges. Additionally, $USDCAD is likely to see a 3-day range increase.

$AUDCHF is showing an ABS squeeze "type 3" with narrow daily and 3-day pivot ranges, increasing the likelihood of a breakout.

Daily and 3-day pivots indicate an increase in volatility for $AUDJPY, and $CHFJPY. 3-day pivots are indicating an increase in volatility for $AUDCAD and $NZDUSD. Additionally, $AUDNZD and $GBPCAD are likely to experience a swing or trend developing.

Included with this po...

Daily Forex Quantitative Trading Ideas And Analysis - 16 April 2018

Highlights from the daily Forex ATI dashboard report going into Monday, 16 April-

Short-term momentum reversed up for two pairs/crosses: $EURUSD, $GBP/NZD and one major: AUD. There were no changes in long-term momentum.

However, $GBPCHF ranked #1 for both ST and LT momentum is at an extreme level and not likely to continue. Similarly, EURCHF is ranked #2 for both ST and LT momentum and is also at unsustainable extreme levels.

Daily price ranges for $EURUSD and $GBPCAD were extremely low on Friday and likely to increase.

3-day price ranges for $GBPAUD, $GBPCAD, $NZDUSD, and $USDCAD were also extremely low as of Friday and likely to increase. Also noteworthy of that bunch - $GBPCAD is on the weekly, daily and 3-day price range list for being at extreme lows. Additionally, $USDCAD has the lowest Short-term momentum rank (#28) which is a high risk factor for reversing the recent selloff.

Another method of detecting price range breakouts is our unique indicator RPM which looks at stat...