Weekly Forex Quantitative Trading Ideas And Analysis - 16 April 2018

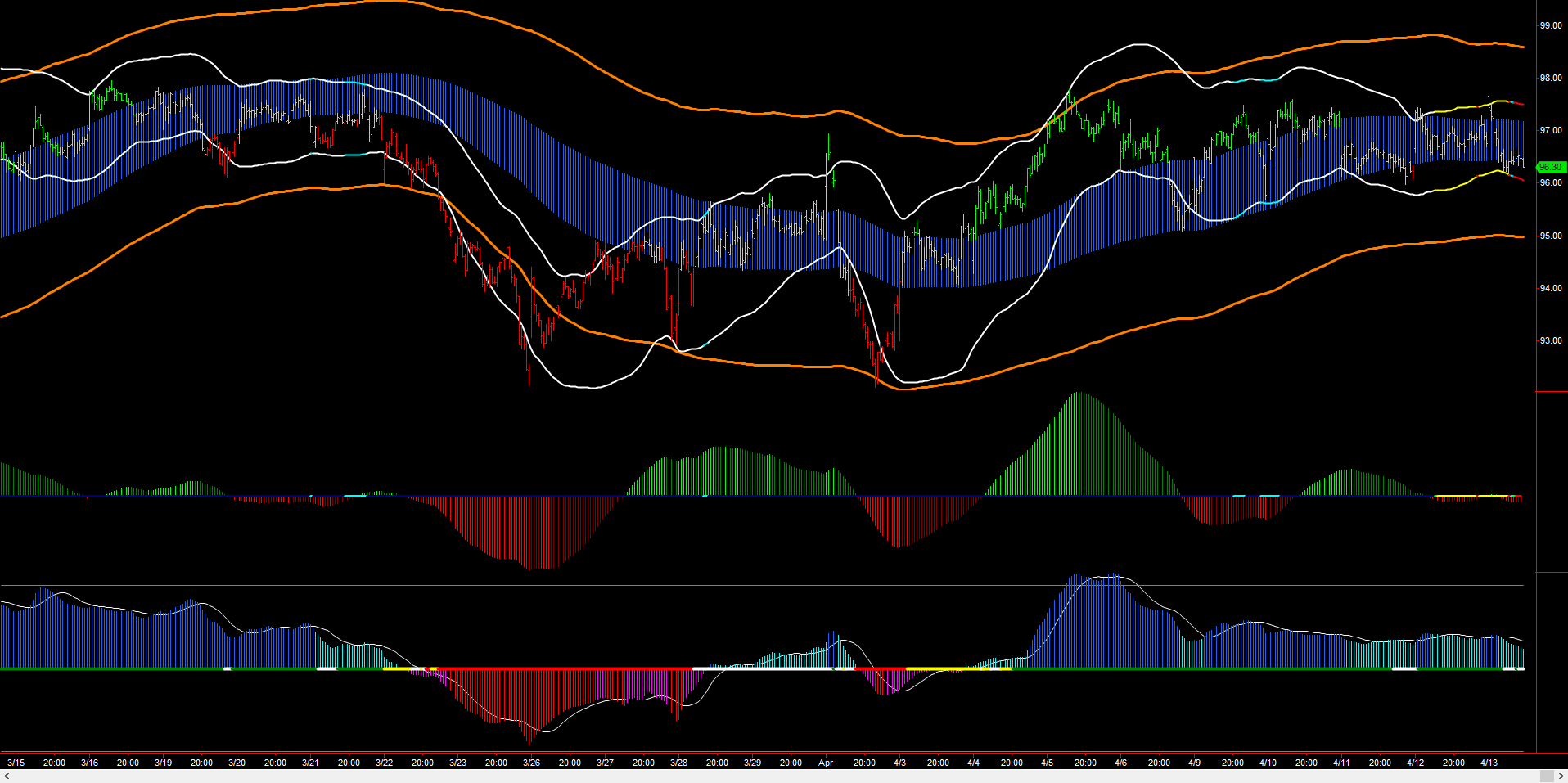

Highlights from the weekly Forex ATI dashboard report going into Monday, 16 April-

Weekly price range compression for $AUD/CAD, $NZDCAD, and $USDJPY reached significant levels and are likely to rebound.

$AUDUSD developed a weekly pivot reversal to the upside.

The weekly pivot ranges are very low for the following pairs which are likely to lead to significant price movement and increased volatility- $EURUSD, $GBPCAD, $AUDCAD, and $USDJPY.

Additionally, a few of the interesting correlation relationships from the ATI report-

$EURAUD currently has a 30-day correlation of 93% with $GBPCAD, yet the 120-day correlation is only 50%.

$GBPAUD currently has a 30-day inverse correlation of -94% with $CADJPY yet the 120-day correlation is only -24%.

$USDJPY currently has a 30-day inverse correlation of -91% with $EURAUD yet the 120-day correlation is only -12%.

The 30-day correlation matrix from the weekly ATI report is included with this post for additional observation.

Please feel fre...

Allstate $ALL has a "type 3" Andersen Bands Volatility Squeeze - Are you in good hands?

Allstate $ALL has a "type 3" Andersen Bands Volatility Squeeze. This is where Bollinger Bands (std deviation), Raschke modified Keltner Channel (ave true range) and Andersen Bands (std error) converge leading to an imminent price breakout. Are you in good hands?

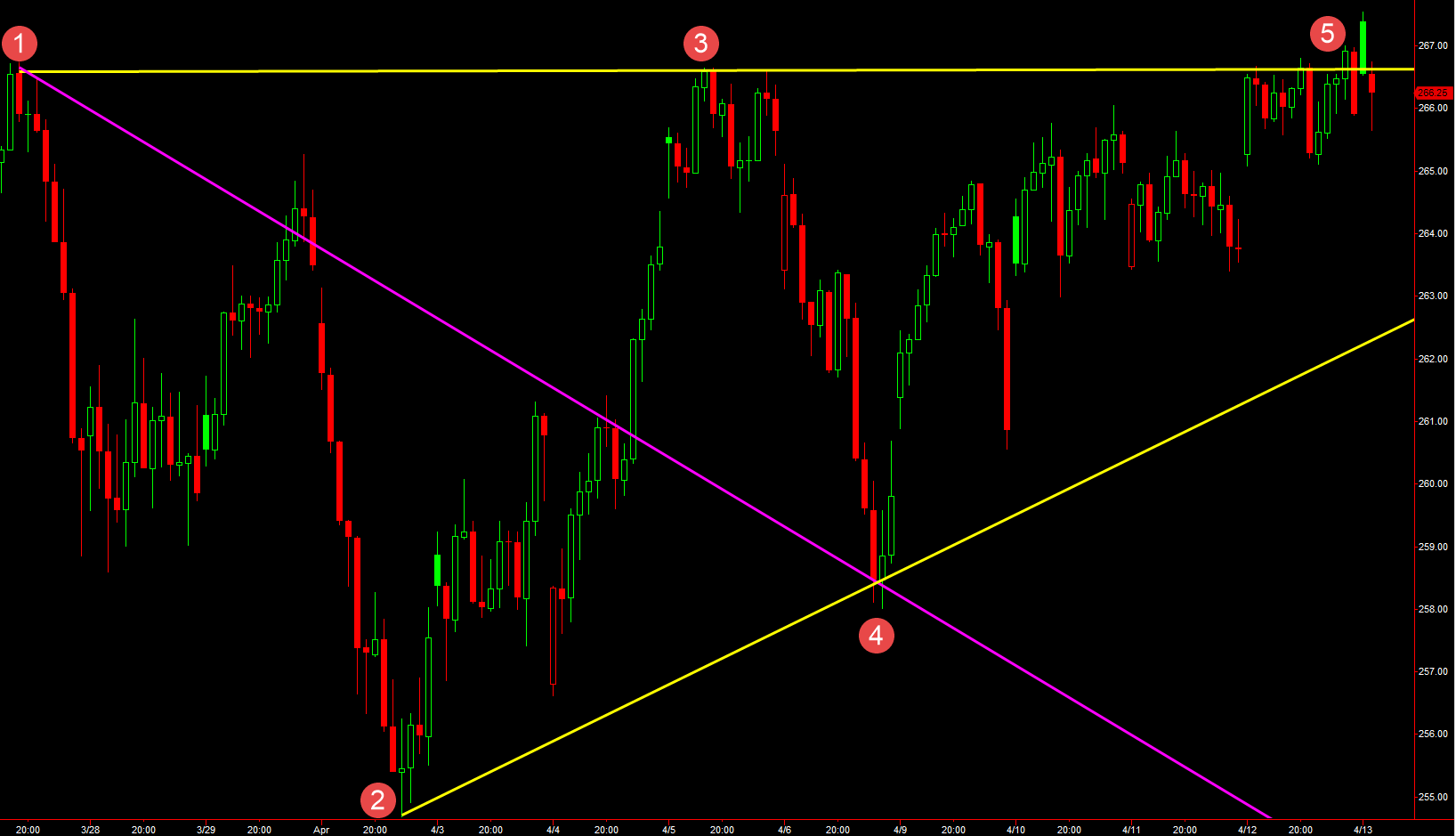

$SPY, $ES_F SP 500 5-wave reversal pattern

$SPY, $ES_F has created a 5-wave reversal pattern. When this happens price tends to gravitate back to the magenta line.

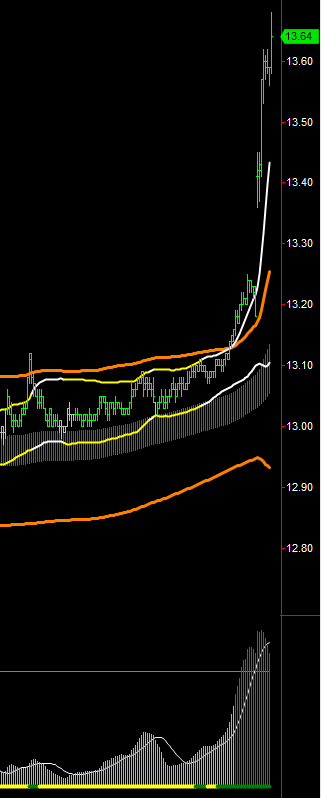

$GE reversal breakout update

A quick update to show how $GE has been resolving the volatility reversal breakout to the upside-

Daily Forex Quantitative Trading Ideas And Analysis - 13 April 2018

Some highlights from the daily ATI report going into Friday the 13th -

$EURAUD reversed short-term momentum to the downside along with EUR as the only change among the majors. CHF is showing an extreme level of downside momentum.

$GBPCHF shows an extremely low long-term momentum level as does $EURCHF albeit at a lesser degree.

$AUDUSD and $EURJPY are both showing extremely low daily ranges which are likely to increase relatively soon.

$GBPAUD and $USDJPY are also poised to expand their 3-day ranges.

$USDCAD, $AUDUSD have extremely narrow daily pivot ranges today.

Similarly, $GBPCAD, and $NZDCAD have extremely narrow 3-day pivot ranges today.

Today's short-term momentum heat map with currency ranking including the majors is attached to this post.

Please feel free to reach out to [email protected] with any questions or comments. We would love to hear from you!

Have a great Friday the 13th!

$GBPCHF short signal

$GBPCHF short at 1.3702 looking for a decent pullback.

$DIS short-term chart is showing a "type 3" Andersen Band Squeeze

$DIS short-term chart is showing a "type 3" Andersen Band Squeeze. This should resolve itself into a volatility spike.

d

d

Is $GE about to move higher?

Perhaps $GE at 13 is preparing for a bounce higher.

Is $GBPCHF about to roll over?

$GBPCHF has been number 1 on the ST momentum heat map, and now at 1.3680 may be about to roll over.

Perhaps $AUDCAD is about to reverse

Perhaps $AUDCAD is about to reverse